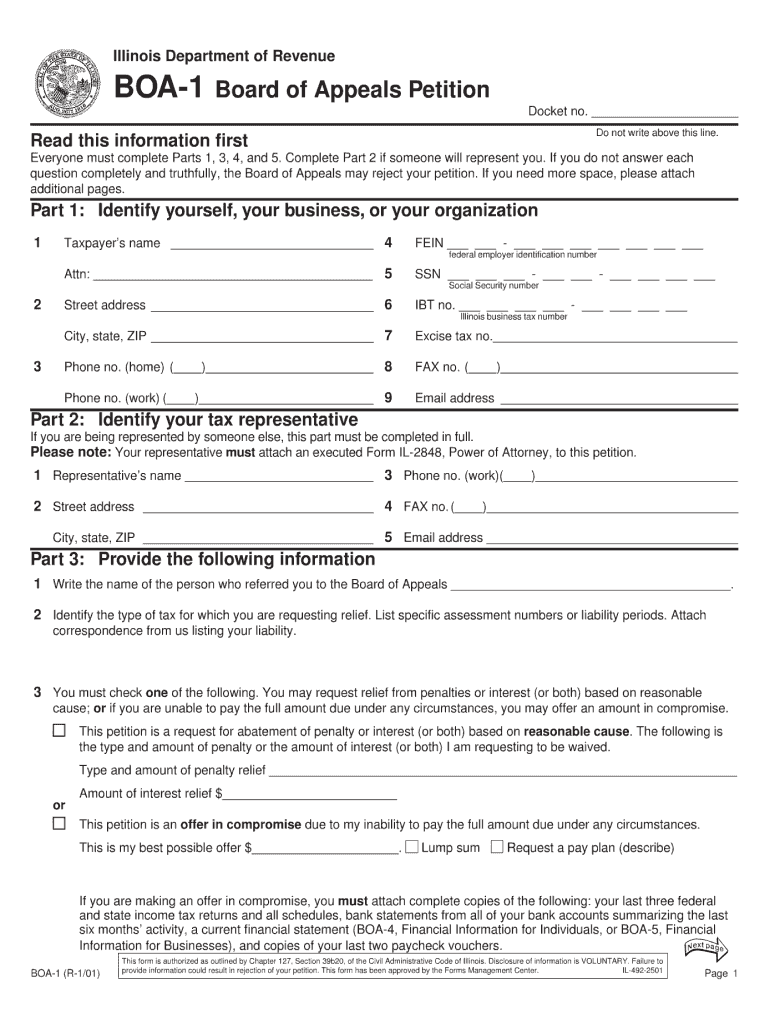

Taxation Situation #dos – The brand new Dependency Deduction

Regardless of if often hotly contested during the judge, this issue is commonly resolved effortlessly for the mediation. Again, through the use of all of our income tax believed app, I can work on other issues, each other with sometimes mate using deduction(s), otherwise busting new deduction(s). The newest records will show the spot where the most readily useful taxation discounts rest. Preferably, I want each other partners to find a taxation offers away from stating the children. I additionally want to avoid this deduction to result in a great squandered income tax advantage to someone.

For individuals who along with your mate generally speaking found a taxation get back owed for the benefits associated with processing given that “Married Filing Jointly,” you may also think postponing the official divorce case decree until after you file taxes one final time

- For folks who and your lover usually each other discover a taxation benefit of saying one or more college students (and they are maybe not phased out of one’s youngster taxation credit because of high money), you cash loans Nixburg no credit check may also plan to split the youngsters.

- When you have a strange level of college students, you can imagine busting each kid after which option the remainder child every year.

- When it comes to one child, it’s also possible to choice the infant every year, for folks who both expect to qualify for an infant income tax borrowing from the bank constant.

A spouse with number one infant custody of children was entitled by the legislation so you can claim the people in his/her infant custody. But not, there are times which i select this deduction bringing wasted on an important custodian if they have hardly any earnings ensuing in every taxation responsibility. The latest reoccurring theme here’s: what is the much time-name work for?

For folks who and your mate typically discovered a taxation return due to your benefits of submitting since “Hitched Processing As you,” you’ll be able to think delaying the state divorce decree up to after you file fees one final time

- When you are an important caretaker, you could potentially negotiate together with your partner so you can relinquish the new state they them if they often read a taxation benefit. More income in your partner’s pocket function extra cash available to shell out youngster help.

- Simultaneously, For those who have a much nonexempt earnings (i.age., payroll otherwise team income) post-separation you may want the fresh new dependency claim to offset the taxation owed on your taxable money.

Once again, a switch taxation factor so you can a separation, however, something very partners overlook. Having the ability to capture this type of deductions into the marital family is certain in relationship. Yet not, up on the fresh splitting up, what happens to them? The answer hinges on what will happen on relationship home. Which assumes the newest relationship home regarding payment, or perhaps is the home for sale?

Always, if a person partner acquisitions another outside of the marital family, might have the benefit of keeping such taxation shelters moving forward. This is an advantage that almost every other spouse can get clean out through to letting go of the house, if they cannot afford to order a special home. Usually, brand new spouse in this status will negotiate almost every other regions of the newest settlement to help you account fully for the loss of it benefit.

If you decide to offer the new relationship domestic, you will find some tax items to adopt depending on the points leading up to this new marketing.

For people who along with your companion usually discover a taxation get back owed into benefits of processing because the “Hitched Processing Together,” you can also consider postponing the official splitting up decree up until when you file taxation one last time

- If an individual partner was staying in the house pending their business which will be responsible for make payment on financial focus and taxation, it appears extremely fair which they perform take-all of your own these types of deductions on the return.

- In the event the partners will always be way of living to one another in the home pending the fresh finalization of your own splitting up and are also sharing every interim expenses, they will invest in split up just as all the home loan appeal and taxation paid-up through to the big date this one lover permanently actions from the house. Due to this the main thing in these activities to determine a certain “get out” go out regarding divorce case contract.