Like magic within past article , this particular article tend to break down some great benefits of the Virtual assistant loan as compared to conventional finance. On top of that, we’ll speak about certain key facts worthy of looking at whenever discussing an effective financing. If the at any point you might be unsure out-of what you are entering, ask your agent otherwise mortgage manager. They ought to be capable make it easier to through the techniques.

If you’ve ever bought a vehicle just before, you can also klnow on down payments. For having some kind of getting interest in a great possessions, most financial institutions require that you foot a few of the statement right up front. Antique lenders require a deposit of approximately 20% or they will certainly ask you for an extra percentage titled PMI. The fresh Va financing does not require hardly any money off and you can do maybe not charge PMI.

What visit our main web site does that it would for you? Say youre trying finance a great $100,000 household. Which have a conventional financing, would certainly be expected to shell out $20,000 at the start otherwise shell out an additional payment towards financial if you standard. The new Virtual assistant mortgage waives brand new $20,000 demands and does not require you to pay so it fee. This enables one individual a house no money off, that’s the opportunity we aren’t getting.

Attractive Costs and you may Choice

An element of the Virtual assistant financing is actually protected by government and you’re permitted to shop around to possess money as opposed to being required to play with a singular source for your loan. What does this mean? It means financing brokers is contending for your needs. When individuals is actually contending for your business, you have made all the way down rates. Down pricing indicate you pay less for the attract throughout the years and you can make security of your house reduced. We will discuss what this means later on.

As for selection, the brand new Va financing possess a few which can help you your own purse later on. First, you have the solution to pre-spend any moment. Certain loans have pre-payment punishment. This simply means that you’re penalized to have paying down your loan very early. Virtual assistant financing are not permitted to charge you getting spending very early in order to pay back your residence as fast as you’ll such. Second, you can utilize the loan to have a home, condo, duplex, otherwise freshly founded family. This type of solutions allows you to features alternatives in your location. Third, this new Va financing are assumable. This simply means you to definitely most of the time you can transfer the loan to another Va-eligible individual. While you are having trouble offering your residence, instance, you could import the loan to another Virtual assistant-eligible private. In the event that rates of interest is rising, this could make it easier to significantly.

The fresh Investment Fee

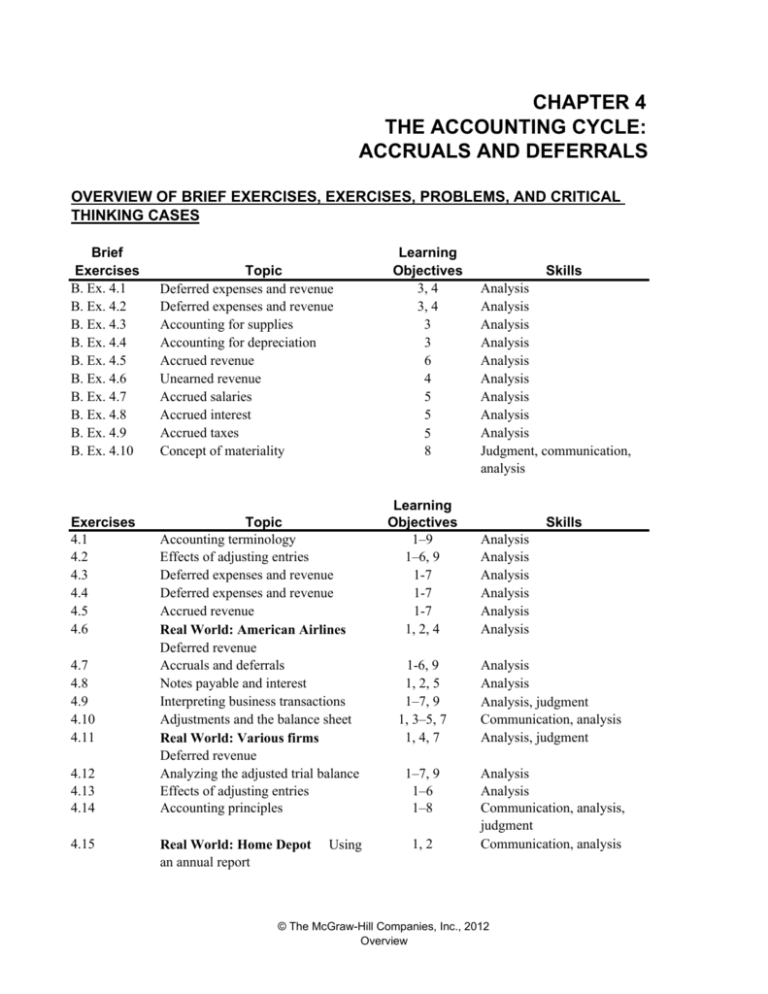

The fresh Va mortgage really does wanted a funding percentage that can help with capital upcoming money. Occasionally, injured pros although some have it fee waived. Consult with your financial to own qualification. The new graph above shows the new funding payment necessary as a share in your home speed. Its a single date commission that one can pay up top otherwise funds also. Going back to our very own prior example, if you buy a great $100,000 house with no money off, the resource commission try $dos,150 if this is the initial house you’ve bought using your Va mortgage.

Building Guarantee and you may loan choice

Sorry for all of your mundane dining tables! However, what is found in this type of dining tables is worth the appearance. The dining table above will assist you to pick whether to play with a beneficial fifteen otherwise 30 year mortgage based on how you will be building equity.

The month-to-month loan payment consists of two fold, dominating and you will desire. Principal try currency heading privately into the possession of the home. Notice is money paid off towards the lender to own financing the loan.

Your goal is always to build sufficient dominant and that means you sooner or later very own the house outright. The tables a lot more than reveal a great $100,000 loan at the cuatro.5% appeal. The major part shows a 30 season home loan, the beds base portion suggests good fifteen year financial. Spot the fee is highest with the fifteen seasons home loan. For the reason that the borrowed funds is actually dispersed more fifteen years unlike 29. However, over an effective 15 seasons home loan you only pay faster appeal and you make dominant smaller. Notice the equilibrium regarding the far right line reduces much faster on the 15 12 months mortgage.

BLUF: If you’re able to afford a beneficial 15 seasons financial, you have to pay of your house reduced and you also shell out faster appeal.

When you are interested in powering the fresh data yourself, follow this link. One area we didn’t explore today are adjustable rates mortgage loans. We extremely counsel you will always be wary about Fingers. People interest in reading much more about Arms, please upload me personally an email. $