Repaying high-desire credit card debt with a minimal-appeal household collateral loan is generally a option to lightens monetary stress – however it can also place your household on the line.

Our very own purpose is to try to offer the equipment and you will depend on your must improve your cash. Although we found compensation from your mate loan providers, whom we will always choose, the viewpoints was our personal. Of the refinancing your own financial, overall fund fees is highest along side longevity of the fresh mortgage. Reputable Operations, Inc. NMLS # 1681276, is labeled here due to the fact “Legitimate.”

Having fun with a property equity financing to pay off personal credit card debt are a sensible move, but it is not risk-free. Since the personal credit card debt typically has a higher interest than just home loan debt, you can spend less and also from debt smaller which have this strategy.

The big risk is that if you cannot repay our home guarantee loan, you could cure your house. Perhaps not repaying your credit card debt may possess really serious consequences, but you might be less likely to eliminate your americash loans Black Hawk property.

Ways to use a house collateral loan to settle credit credit obligations

To repay credit debt with a house equity loan, you’ll very first must be eligible for a house security financing. Domestic guarantee ‘s the part of your house’s well worth that you try not to are obligated to pay with the financial. Like, in case your home is worthy of $350,100 and also you are obligated to pay $250,000 in your first mortgage, your security was $a hundred,000, or just around twenty-eight.5%.

A home equity loan, often referred to as a second financial, allows you to supply a portion of one $a hundred,one hundred thousand given that a lump sum payment. You are able to the cash however require and take upwards to help you 3 decades to repay they.

New enough time repayment months and you may repaired, down interest can instantaneously decrease your monetary fret. Of course, if you end trying out the new credit debt, your property guarantee mortgage can help you make regular improvements with the getting out of loans for good.

Family collateral mortgage limitations

On average, the essential you might usually borrow within earliest and you can 2nd mortgages is 80% of your own residence’s really worth. That it percentage is named your own combined financing so you can value proportion, otherwise CLTV.

Some lenders enjoys more strict loan criteria and you can restrict credit so you’re able to 70% of CLTV, although some features loose conditions and might let you acquire up to help you 90%. Debt character will also apply to how much you could potentially obtain.

Very, let’s hypothetically say again that household really worth was $350,000, your own home loan principal harmony is $250,000, as well as your domestic guarantee try $one hundred,one hundred thousand. With a beneficial $250,000 home loan harmony, you’re already borrowing against 71.5% of the residence’s worth. This new strictest lenders that restriction CLTV in order to 70% won’t agree your residence equity loan application.

Other people you will enable you to take-out a house guarantee mortgage (otherwise a property equity personal line of credit) to possess between $31,100000 (80% CLTV) in order to $65,000 (90% CLTV).

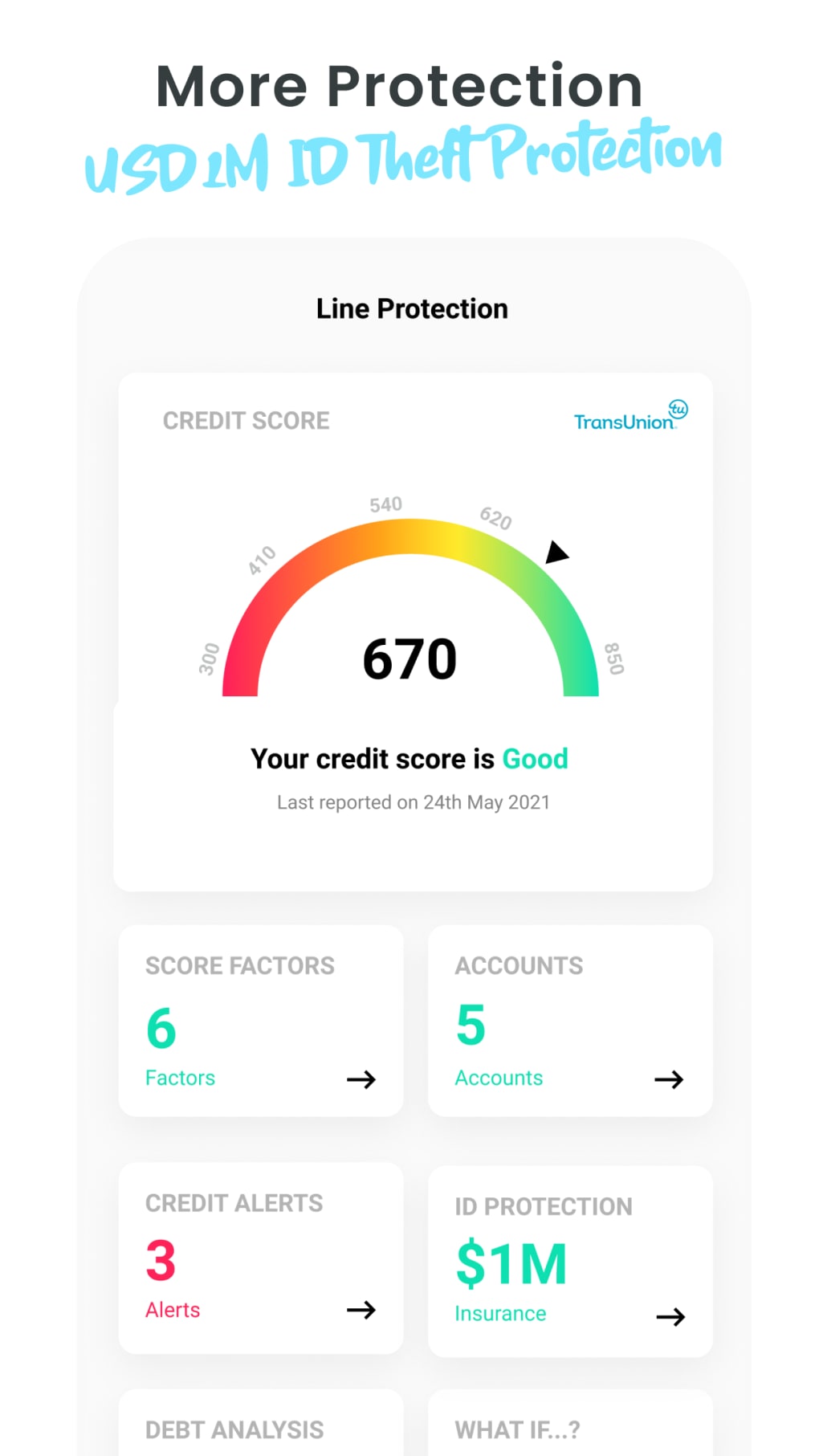

- A credit history of at least 620

- Proven money

- An obligations-to-money proportion of 43% otherwise faster

Advantages of choosing a home guarantee financing to repay borrowing cards financial obligation

- They offer all the way down rates of interest than handmade cards. The common credit card interest for anyone carrying a balance is roughly 17%, depending on the Government Set aside. However, house guarantee loan rates of interest can also be work with only 3% for extremely accredited individuals.

- They have a lengthy repayment several months. A home collateral loan’s name is just as long while the 30 ages.

- You’ll enjoy straight down monthly installments. A lower interest plus more for you personally to repay the loan normally improve your income.