Using your house equity would be an effective economic service to possess of many residents. When you have had a property within the Texas for at least a few years, your likely keep equity in your home. There are two common financing alternatives for opening your own equity. Property Collateral Personal line of credit and you will an earnings-Away Home mortgage refinance loan an organized in a different way, but one another allow you to make use of domestic equity.

Researching an effective HELOC vs. a cash out Re-finance will be include a diagnosis out-of which off loan works well with your position. The kind of lien, financing repayment, interest solutions, or other variations in these types of finance makes it possible to decide which sort of domestic guarantee financing you prefer.

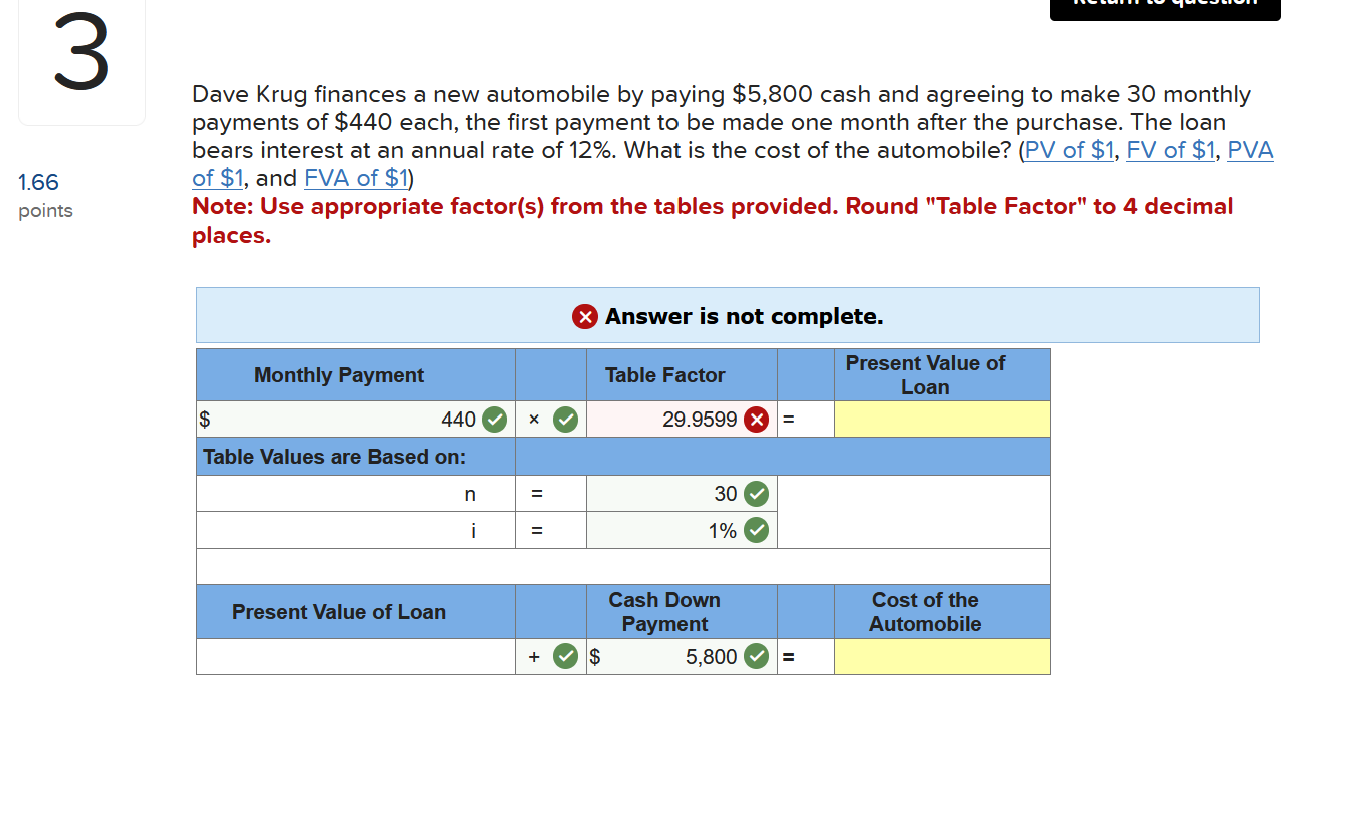

Property Variety of:

![]()

HELOC finance are only able to be studied for your first household. Cash-Aside Refinance finance can be used to access brand new collateral from inside the much of your quarters, an extra household (vacation), otherwise an investment property.

Lien Sort of:

A property collateral credit line is a kind of next financial. Which means it is another lien in your number one quarters. Finance companies often imagine second mortgages due to the fact higher risk finance plus they can come with more strict certification guidance.

Cash-out refinance loans is a great refinancing of your own first-mortgage, with the ability to mark dollars from your offered family security. You could potentially have the option to modify otherwise increase brand new name of one’s mortgage.

When you yourself have in past times utilized a funds-Out re-finance on your home, Texas home loan advice don’t let you to receive the second lien on a single assets. There’s also a great several month prepared months to own property owners whom enjoys utilized a profit-away financing, ahead of they can make personal loan for wedding an application for other cash out mortgage on same assets.

Qualifying Credit history:

A cash-out re-finance requires the very least 620 FICO credit score, it is a conventional mortgage loan product. A good HELOC financing is considered increased exposure money to have financial institutions and will tend to require good 700 or even more FICO credit history in order to meet the requirements.

Debt consolidation:

Not just really does the better credit history specifications create a whole lot more hard for property owners to help you possibly qualify for a HELOC, these types of fund convey more stringent obligations so you’re able to money assistance.

Having property owners that are looking to pay off high attention credit cards loans or any other higher interest funds, a cash-out Refinance loan would be easier to be eligible for. Your debt cost are going to be out of-place in the latest computation into financial obligation to help you income ratio to possess a cash-out refinance mortgage. And work out cash-out re-finance loans easier to qualify for once you are looking to combine debt.

Many HELOC finance do not allow your debt pay-offs to be determined from the debt so you can earnings qualification advice. This is often since your HELOC installment is yet another month-to-month commission, and will not eradicate portion of the monthly income that’s seriously interested in obligations fees.

Closing costs:

Among the glamorous aspects of providing a great HELOC has zero settlement costs. Because a funds-out financing refinances your first financial, there are several settlement costs with the closure your loan.

People who happen to be trying borrow a reduced amount of money getting family home improvements commonly thought a HELOC the higher package. If you’re looking so you’re able to use less than $30k out of your security and you will propose to pay back the fresh lent matter rapidly, upcoming a beneficial HELOC may be what you’re searching for.

Although there are not any closing costs, HELOCs have another kind of attention and will cost more in the long term. Let’s capture glance at the framework of notice for every style of financing below.

Rate of interest:

Most HELOC loans are offered with a changeable appeal rate. Much like the way that credit card desire is arranged, HELOC financing desire most definitely will change which have action on the industry.

Becoming one minute mortgage, HELOC financing are considered to get on increased danger of default. This can signify the rate available on HELOC fund is usually highest.

The interest rate of many cash-out refinance fund is restricted. A fixed rate of interest, cannot changes for the whole loan name.

Loan Cost:

Given that a second financial brand new payment per month for the a great HELOC commonly end up being a supplementary payment per month, separate from the first-mortgage commission. With a variable interest rate, the quantity owed from inside the interest to suit your HELOC fee varies over the years.

That it family collateral line of credit makes it possible to use currency while in the an appartment amount of time called an excellent mark several months. In draw period, minimal monthly premiums is actually put on the interest on count borrowed. After the latest place draw period you will no prolonged have the ability to mark from your guarantee plus loan often go into the fees period. Payments made into the cost period was used on both dominant and focus due to your mortgage.

In contrast, the mortgage payment on a cash out refinance is more constant. The degree of bucks lent out of your guarantee is actually folded on the your first home loan. With a predetermined interest, the of your own dominant and you may attract part of your own monthly homeloan payment will not changes into lifetime of the borrowed funds.

Just what should i rating, HELOC compared to. Cash-out Home mortgage refinance loan?

The home loan and you may economic attitude differs per individual. Deciding if a home collateral credit line or a cash away re-finance is better fitted to your financial means is a thing that you should talk with an authorized financial representative.

Our company is right here to provide a peek at your best financial choices. All of our objective would be to help you access an educated mortgage readily available to you. Reach out to a home loan specialist into the our team together with your house security loan inquiries now!