Can you use a Va Loan For A residential property?

Draw Severino is actually a beneficial You.S. Army head on supplies to own ten years, an extend that given an opportunity to play with a good Virtual assistant home mortgage to purchase a first house. However, the guy need some thing so much more.

Severino used the system when you look at the 2015 towards the a home within the Orlando having an additional hold tool, otherwise ADU, regarding the garden. He rented you to out to defense the majority of their financial and you may lived in part of the family meet up with the brand new occupancy requirement off an effective Virtual assistant financial.

When he transferred to Dallas during the 2017, the guy marketed the place when you look at the Orlando and you may recouped his complete Virtual assistant entitlement, he used on a second financing to order a beneficial duplex, once more with no currency down.

If that’s the case, I made use of the assets given that my personal first house and just have hired away 1 / 2 of your own duplex, told you Severino, today the master of Top Tx Household People LLC inside the Dallas.

The latest Virtual assistant mortgage is without question one of the best positive points to solution people Aristocrat Ranchettes bank land loan and you can licensed consumers. Its some challenging to set up rather than recognized within the attributes. However, I strongly recommend the next program so you can anybody who qualifies.

Severino’s tale provides one example away from how different types of Va mortgage brokers can be used to the capital characteristics which have you to definitely extremely highest caveat: The home have to be bought as the a first residence.

Their story is an excellent exemplory case of exactly how licensed home owners is have fun with passive streams of cash to further defray financial will set you back.

I usually checked new Virtual assistant financing if you wish out-of getting into a home, Severino said. The possible lack of out of a mortgage emptying me personally four weeks has greet me personally new freedom to higher buy my personal company.

Exactly how Va Funds Performs

An excellent Virtual assistant loan was a mortgage, otherwise an excellent re-finance supported by the fresh new U.S. Agency away from Experts Circumstances. The application form is meant to give casing assistance so you’re able to active obligation army users, pros, as well as their partners. This is not meant to be an investment unit.

To take out a great Va financing, you ought to first qualify for a certification from Eligibility. The requirements will vary a little having productive obligations provider players and you will experts. National shield, reservists, the individuals discharged due to hardship otherwise specific medical conditions and you may thriving partners may also meet the requirements.

The great benefits of Virtual assistant home loans exceed to acquire a current house while the an initial quarters you need to include building, fixing, refinancing and you can adapting residential property for someone having an impairment.

The way it operates, new You.S. Department of Veterans Situations guarantees part of the mortgage very lenders also provide significantly more good terms and conditions than simply old-fashioned mortgage loans.

Due to the fact process will take more than being qualified for a financial loan away from system, men and women terminology range from no deposit, zero personal financial insurance policies, a lower life expectancy interest and you will settlement costs, and friendlier credit score minimums.

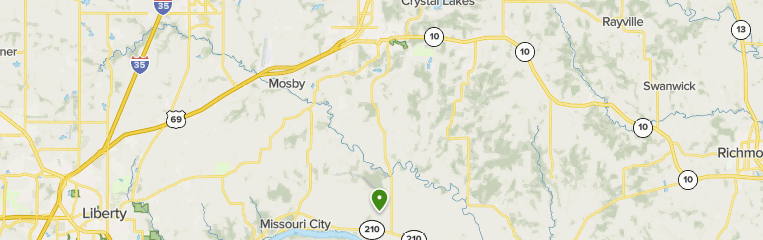

In my opinion the many benefits of Va loans exceed their constraints away from capital properties, specifically for experts prioritizing lowest initial will set you back that have good terms, told you Yancy Forsythe, an aquatic Corps vet and maker away from Missouri Valley Residential property. If your main goal will be to spend money on local rental qualities versus occupying them, most other loan items could be a better option.

Virtual assistant lenders is actually designed for number 1 residences. Therefore, you simply can’t use an effective Virtual assistant home loan to purchase a home without aim of residing in they.

When you take from mortgage, you need to indication paperwork indicating the purpose to make use of the house or property just like the a first residence. With that skills become rewards you to suggest Va mortgage brokers.