Purchasing your basic residence is an intricate process ( listed here is techniques which will make it easier to ). A majority from it was selecting the right financial. Its an economic commitment that eat up a significant bit of your earnings that can effect your for decades, so it is critical you result in the best choice. All the information lower than helps you decide which mortgage(s) is generally right for you.

Va Money

Talking about mortgage loans provided by antique loan providers which can be supported by brand new U.S. Institution off Experts Products. He’s only available so you’re able to army people, pros, in addition to their group. You will find several gurus and additionally well low interest, restricted closing costs, no downpayment, together with no home loan insurance costs.

USDA Financing

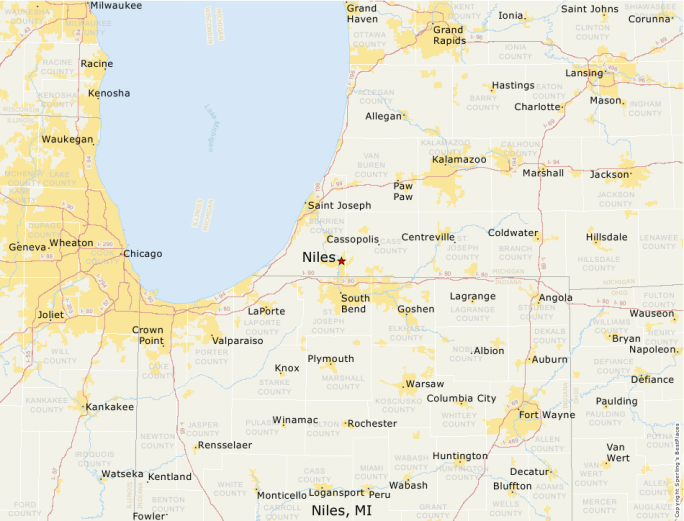

If you’re looking to buy property into the an outlying city (away from Dual Cities) you have to know a home loan about You.S. Department from Farming . You must meet the money standards (earning lower than online payday loans New Hampshire 115% of the average money into the urban area). These mortgages none of them a down payment and gives well low interest.

HUD Rehabilitation Funds

If you’re considering buying property which can need some work, a treatment mortgage supported by this new U.S. Department of Homes and you may Urban Invention (HUD) could help you. You’d pull out what exactly is named an effective 203(k) loan. This method makes you borrow sufficient currency so you’re able to one another get a house and then make expected fixes to help you it. Because bodies assists ensure these loan, you ought to go through a national Construction Government (FHA) accepted bank to help you be eligible for and you will found good 203(k) loan.

FHA Money

The fresh FHA supports most other financing apps around the country having first-date buyers which have lower income. New money features low-down percentage requirements (as low as step 3.5% of your home’s rates), lower settlement costs, and a simplistic borrowing approval processes. You do have to work well with a loan provider that’s approved from the FHA .

Start up off Minnesota Housing

Minnesota’s Condition Housing Loans Agencies offers advance payment and you can settlement costs loans so you’re able to income-certified consumers. The applying is called Kick off and qualified borrowers can access as much as $17,000 for the service. These types of fund do not have appeal and are generally not required to be paid down until the first-mortgage in your residence is paid off. These fund will be in conjunction with other very first-date homebuyer apps.

Personal Loan providers

Particular banking companies or any other lenders (plus private areas and you may towns and cities from inside the Minnesota) give special mortgage loans having basic-go out homebuyers. not, the details (rate of interest, words, availability, etcetera.) change daily. This new Minnesota Homeownership Center’s web page to your industry people hyperlinks in order to a variety of the modern offerings.

TruePath Financial

- A thirty-12 months name which have lower fixed financial

- Costs lay during the 30% of your own borrower’s money

- No deposit requirements

- Down payment assistance when needed to really make the purchase reasonable

- Zero mortgage insurance coverage

- Settlement costs recommendations and a lot more financial assistance complete

The newest TruePath Financial exists using TCHFH Financing, Inc., an entirely-owned part out-of Dual Places Habitat having Humanity. Financing is employed to order land on the 7-condition town part of Minneapolis and you will St. Paul. A TruePath Mortgage are often used to pick a home depending by Twin Locations Habitat or a house which is on the market with the open-market.

Was The Home loan Calculator

- Which calculator does not determine your own genuine financial matter.

- This doesn’t make sure Twin Places Habitat is also lead a complete guidance number listed.

- To be eligible for an excellent TruePath Financial, you need to satisfy all income or other underwriting conditions.

- Whether or not your cost suggests you can afford a whole lot more, a buy which have a good TruePath Home loan could be simply for the limitation amount borrowed.

There’s a lot to take on when shopping for your first family. With the amount of mortgage choices, it may feel a frightening task. Look at Dual Towns and cities Habitat’s Basic-Big date Homebuyer Guide – it’s an effective place to begin to really make the process easier, one step at a time.