Choice Name: Refinancing a mortgage Will set you back: Here is what You must know

It’s appealing so you can refinance their home loan when rates is actually lower whilst might lower your monthly obligations. Yet not, you will find a capture! In addition to the financing arrangement payment, people have to incur almost every other refinancing can cost you to accomplish the procedure.

So, do you know the total refinancing will set you back? Read on to ascertain different fees you should spend whenever refinancing so you’re able to determine if it is still the most suitable choice to you personally. But before we begin, let’s speak about what mortgage refinancing try additionally the reasons to re-finance.

Popular Reason why Property owners Re-finance Their Home loan

Whenever residents re-finance the mortgage, he is essentially obtaining a separate mortgage which have most readily useful attention pricing otherwise a different payment per month bundle. Take a look at the top reasons so you can re-finance (relationship to As to the reasons Refinance’ blog post) your own financial below:

Way more In balance Monthly obligations

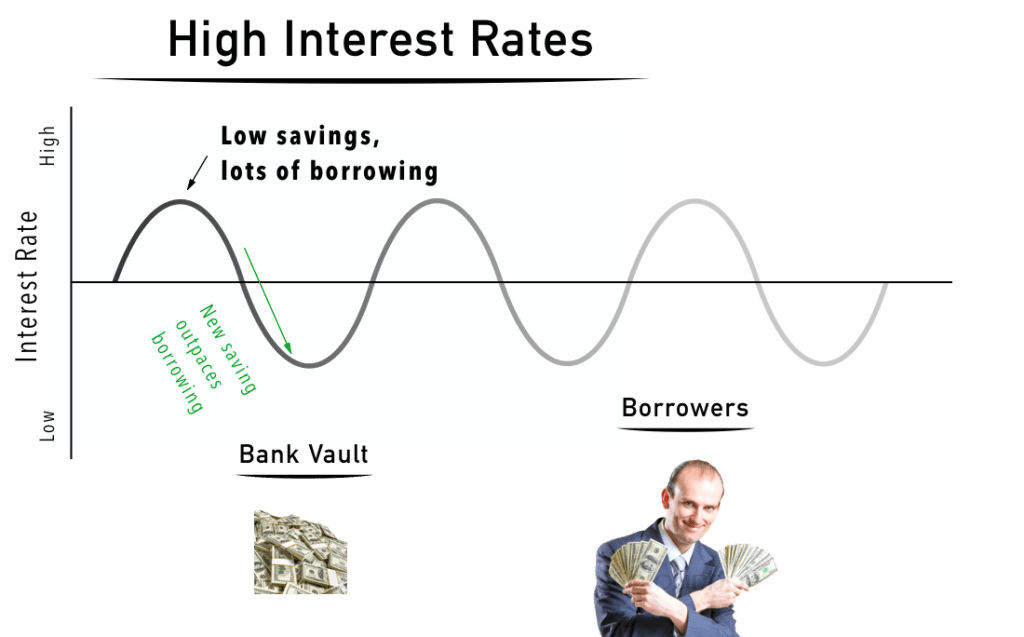

- The most used reasoning home owners refinance will be to all the way down the monthly mortgage payments. You are astonished the tiniest difference between the home loan rates is also greatly feeling your own costs.

Reduced Mortgage Period

- Additionally, it’s also possible to refinance their home loan so you’re able to safer a shorter financing months. That’s, whenever you manage they. By the cutting a 30-seasons loan to 15 years, you can pay off your loan fundamentally and you will accelerate the procedure out of having your house.

Save money on Complete Interest

- A few things decide how far appeal you only pay on the lives of one’s mortgage: interest and you http://www.availableloan.net/installment-loans-il/phoenix/ will home loan label. Because you beat these facts, you can save a large amount to your appeal through the years.

Complete Mortgage refinancing Will cost you

The can cost you involved in refinancing your own financial become a selection out of charges not as much as swinging costs, running fees, taxation, and you will people penalty fees that you could be subjected to.

It is vital to observe that refinancing costs may differ as other finance companies costs various other charges so you can finalise your own refinancing mortgage. Hence, it certainly is advisable to research rates and you will compare prices to obtain an educated package.

Moving Will set you back

The word moving costs’ means every charges you pay when you re-finance their financial. Listed here is a post on new swinging costs and you may a short explanation of every so you’re able to greatest comprehend the overall refinancing will cost you requisite.

1. Possessions Valuation Commission

The house or property valuation percentage is actually necessary, and is also the purchase price inside in the event the bank’s committee valuer makes a beneficial valuation declaration. The fresh new report will be outline their property’s genuine ount.

Following, your home valuation declaration would be sent towards lender having opinion. Even though it is you’ll to make use of an external valuer in order to conduct the latest assessment, you should make sure that bank believes so you’re able to they very first before continuing.

dos. Mortgage Arrangement Percentage

After you submit an application for a mortgage, you’ll enter into a binding agreement together with your chose financial entitled the loan Agreement.

These files require a professional financial attorney to set up you need to include certain costs: stamp duty payment, court fee, and you may disbursement commission.

Typically, this type of fees vary away from two to three% of your loan amount, but they may go highest should your amount borrowed was reduced than a quantity.

- Stamp Duty

- Stamp obligation is basically an income tax that you pay for the authorities. Courtroom documents eg instruments of transfer and you will loan preparations to have possessions requests are accountable for stamp duty.

- The stamp duty payment towards the loan agreements is determined at the an effective repaired 0.5% speed, which is used on an entire value of your loan amount.