Knowing the Mortgage Procedure

Now that we have talked about some of the technology stuff, why don’t we step-back and walk-through the best scenario within the which you’ll be utilizing your expertise of home loan axioms to shop for a special household.

Property Step 1 Select a lender

I’m sure, I am aware domestic shopping is the enjoyable region. Imagining exactly what you’d do to which cooking area or just how might utilize one den, just like with the all of these Tv shows. But the right mortgage and you may mortgage provider is essential so you’re able to a beneficial confident house-to invest in sense. Store your options basic, in advance of you may be every giddy across the cupboard area. It is simpler to listen to such things as rates and settlement costs that way.

Property Step two Rating Pre-acknowledged

You earn one or two financial hunting great tips on that one. Earliest, pre-approved financing is in fact required when selecting a property. Certain real estate professionals would not also start demonstrating you qualities until you have got the money lined up. And you may a great pre-approved mortgage will make it better to move quickly on good family you really want. The home loan provider also make you a formal page demonstrating how much you have been approved for only to store some thing authoritative.

Next, the new pre in the pre-approved right here does not mean the newest monetary blogs is paid and over. It just setting you have got a substantial manifestation of simply how much you could potentially invest and that their financial is fairly specific you’ll qualify so you’re able to use one matter https://clickcashadvance.com/loans/parent-loans/ from their website if you choose to purchase a home. That is in the event the genuine documentation starts.

Property Step 3 Evaluate Land

In the long run, the fun part! Do not be see your face just who finds something very wrong with each household, however, neither in the event that you diving at every opportunity. Create a preliminary set of need certainly to haves, desires, hates, and really should stop, and you will do that part really ahead of time ahead of you’re stuck up about time. After that, call it you go. Even if you tailor it along the way, this helps you retain focused please remember the concerns.

Property Step Build a deal

And here a beneficial realtor is really very important. They’re able to help you find out a fair undertaking render built towards the hobby in the industry, the room, the home itself, etc. If the home offer rapidly, it could be unnecessary and then make a deal lower than price tag. At the same time, there clearly was constantly zero harm carried out by a tiny cautious settling. It generally does not have to be all about the fresh new selling price, often possibly manufacturers will commit to leave the latest washing machine and more dry otherwise replace you to definitely strange element of carpeting in place of decreasing their inquiring price.

Real estate Step 5 Brace yourself (Now the actual Documentation Begins)

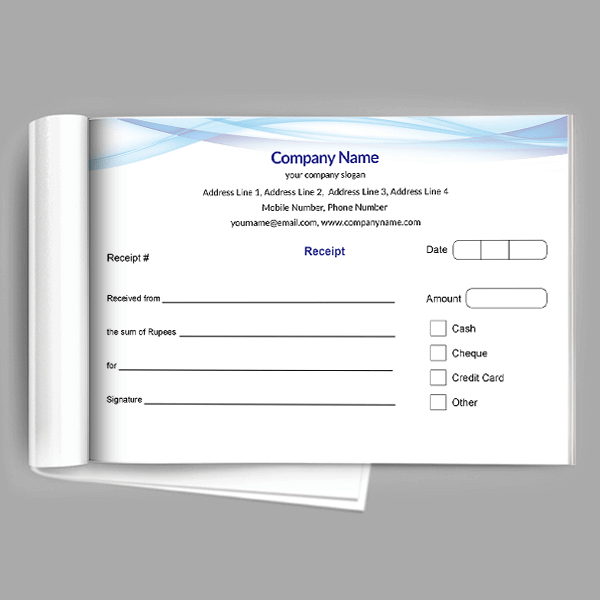

Whether your give try acknowledged, the financial institution will demand one complete a mortgage application also to fill in paperwork regarding your revenue and you can credit history spend stubs, W-2s, bank comments, tax returns, etc. Such could well be evaluated from the a keen underwriter, whose number one means should be to studies new documents provided and ensure you to things are in check. You’ll find bank standards to be fulfilled and regulators direction in order to be implemented additionally the whole topic tends to make the head twist a bit for those who let it.

In the event it enables you to become any better, brand new underwriter is additionally computing the value of the house or property in the matter and you may making certain they fits all types of requirements and you can assistance as well. They could order an esteem review or any other monitors in the event the truth be told there are concerns. These are all home mortgage basics; it doesn’t mean there is problems.